Afterpay vs. Other Payment Options: Which is Best for Your Small Business

Due to the ever-evolving world of digital payments, small business owners are constantly searching for the most effective and customer-friendly payment solutions. One of the most popular options today is Afterpay, a buy now, pay later (BNPL) service that allows customers to purchase in installments. This article will compare Afterpay to other payment options, helping you determine the best choice for your small business.

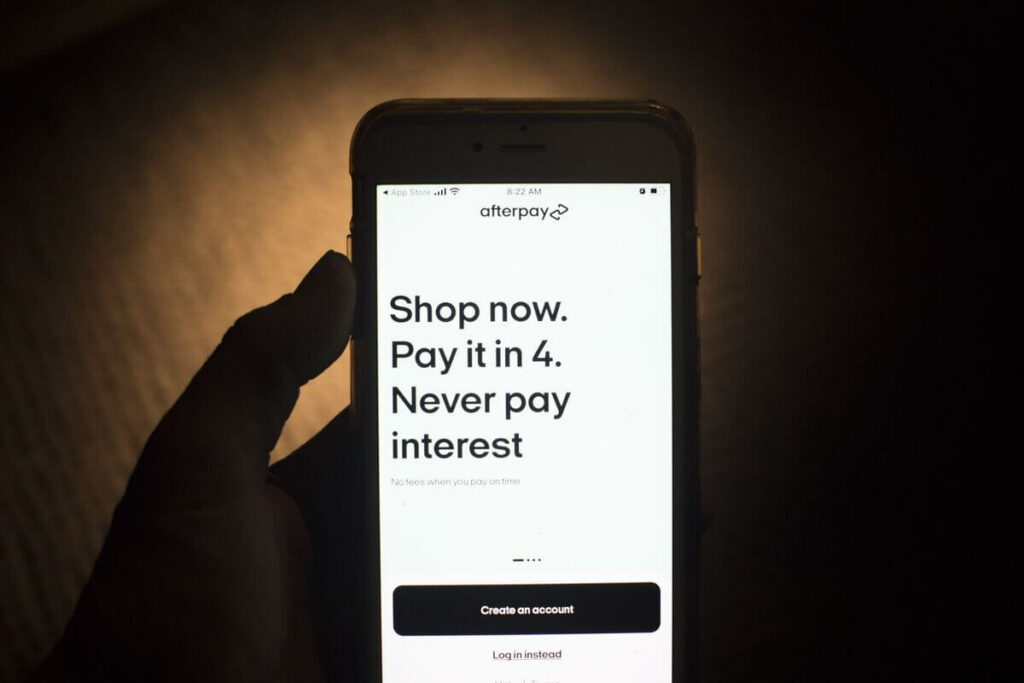

Understanding Afterpay and Its Benefits

Afterpay is a BNPL service that enables customers to split their payments into four equal installments, payable every two weeks. This flexible payment plan is highly attractive to customers. It allows them to manage their finances more efficiently without incurring interest or fees (if payments are made on time). The main benefits of Afterpay for small businesses include the following:

- Increased sales: Offering Afterpay may encourage customers to make larger purchases or buy more frequently, as they can spread the cost over time.

- Enhanced customer loyalty: Afterpay users often return to stores where they can use the service, promoting repeat business.

- Improved cash flow: Businesses receive payment upfront, while customers pay in installments, ensuring a steady cash flow.

Other Payment Options for Small Businesses

To make an informed decision about whether Afterpay is the best choice for your small business, it is crucial to understand alternative payment options:

- Traditional credit card processing: Accepting major credit cards (Visa, Mastercard, American Express) is a must-have for most businesses. These payment methods are widely accepted and trusted by consumers.

- PayPal: This well-known online payment system enables customers to make purchases using their PayPal accounts, which can be funded by credit cards, debit cards, or bank accounts.

- Square: Square offers a point-of-sale (POS) system and payment processing solutions for small businesses. Its hardware and software solutions cater to various industries and can be easily integrated into your existing setup.

- Stripe: A popular online payment processor, Stripe allows businesses to accept payments through websites and mobile apps. Stripe supports various payment methods, including credit cards, digital wallets, and international currencies.

Factors to Consider When Choosing a Payment Option

When deciding which payment option is best for your small business, consider the following factors:

- Customer preferences: Assess your target audience and their preferred payment methods. Offering a variety of options can help meet customer needs and increase sales.

- Fees and costs: Each payment solution has its associated fees, such as transaction fees, setup fees, and monthly costs. Analyze these expenses to determine the most cost-effective option for your business.

- Integration and compatibility: Ensure that your chosen payment method can be seamlessly integrated into your existing website or POS system.

- Security: Prioritize payment solutions that provide robust security features, protecting both your business and customers from fraud.

When to Choose Afterpay Over Other Payment Options

Afterpay can be an excellent choice for small businesses that cater to customers who prefer installment-based payments. Consider implementing Afterpay if:

- Your products or services have a higher price point, making them more suitable for installment payments.

- Your target audience is comprised of younger, tech-savvy consumers who are familiar with BNPL services.

- You operate in a competitive market, and offering Afterpay could provide a unique selling point.

When to Opt for Alternative Payment Options

While Afterpay has its advantages, it may not always be the best choice. You may want to consider other payment options if:

- Your products or services have a lower price point, making installment payments less relevant

- Your customer base is less familiar with or less interested in BNPL services.

- The fees associated with Afterpay are higher than other payment options, making it less cost-effective for your business.

- You already have a comprehensive range of payment methods in place, and adding Afterpay may not significantly improve customer satisfaction or sales.

Combining Multiple Payment Options for Maximum Benefit

To maximize your business’s potential and cater to a diverse customer base, consider offering a combination of payment options. By providing traditional credit card processing, PayPal, Square, or Stripe, along with Afterpay, you can attract a broader range of customers and boost sales.

Incorporating multiple payment options also ensures that customers who may not qualify for Afterpay or prefer other payment methods still have the opportunity to make purchases from your business. This approach can contribute to an overall positive customer experience, increasing loyalty and repeat business.

Conclusion

Deciding on the best payment option for your small business is an essential aspect of success. While Afterpay can be an attractive choice for businesses looking to appeal to customers seeking flexible payment plans, it is essential to weigh its benefits against other payment options such as credit card processing, PayPal, Square, and Stripe.

By carefully considering factors such as customer preferences, fees, integration, and security, you can determine the most suitable payment solutions for your business. In many cases, offering a mix of payment options can provide the best results, ensuring that you cater to a wide range of customer needs and preferences while maintaining a healthy cash flow.

Responses