The Role of Escrow in Selling a Business Transaction

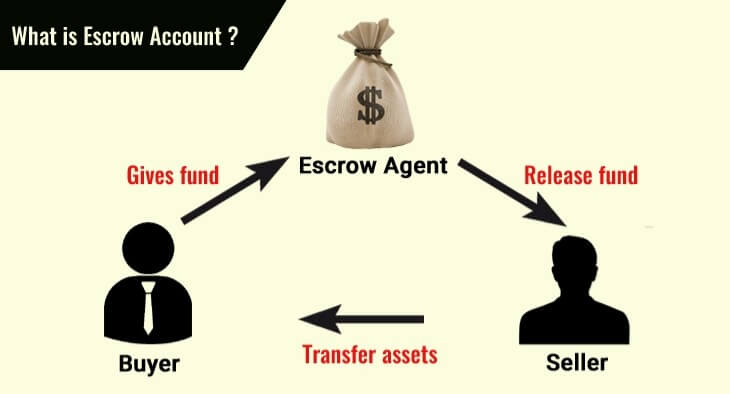

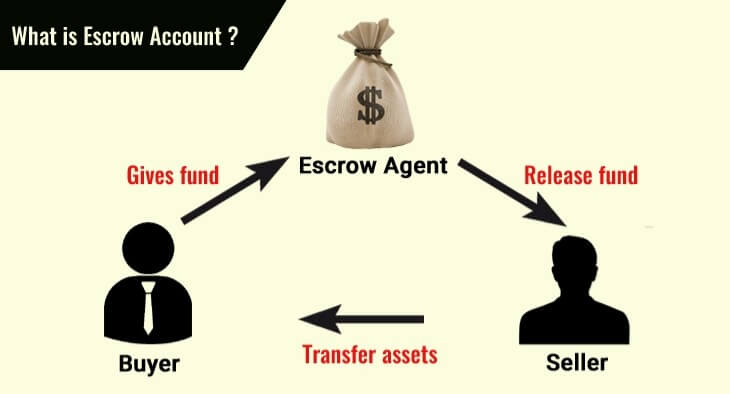

Escrow refers to a financial arrangement where a third party holds and regulates payment of the funds required for two parties involved in a transaction. It ensures that transactions are carried out according to the agreed terms and conditions. Escrow becomes important in deals where significant amounts money are involved, where a certain number of obligations must be fulfilled before a payment is released.

The importance of escrow in business transactions cannot be overstated. It ensures a fair, transparent transaction process, reduces the potential for disputes, and enhances the confidence between transacting parties. By using an escrow service, both buyers and sellers can venture into high-value transactions with an added layer of security.

Understanding the Role of Escrow in Business Transactions

An escrow service provides a critical layer of security in business transactions, particularly in deals involving real estate, online businesses, or any high-value items. The key role of escrow in business transactions is to hold funds securely until all the conditions of a contract are met.

Escrow in Real Estate Transactions

In real estate transactions, escrow accounts are typically used to hold funds needed for closing costs, or to hold the buyer’s payment until the final inspections are completed. By doing this, the escrow service ensures that the seller can’t unfairly retain the buyer’s money, and the buyer can’t withhold payment until they’re satisfied with the final condition of the property.

Escrow in Online Business Transactions

In the realm of online businesses, escrow plays an equally vital role. Online transactions often involve inherent risks, such as non-delivery of goods or services, or non-payment after delivery. Here, escrow services act as a neutral third party that holds the buyer’s payment until the goods or services are delivered and accepted.

The Escrow Process: A Step-by-Step Guide

The process of using an escrow service in a business transaction involves several steps.

- Agreement on Terms: Both parties agree to the terms of the transaction, which includes the price, timeline, and conditions under which the funds will be released.

- Buyer deposits funds in Escrow: The buyer then deposits the agreed-upon funds into the escrow account. The escrow service verifies the deposit, providing the seller with assurance that the funds are secure.

- Seller fulfills the agreement: Once the funds are verified, the seller proceeds to fulfill the terms of the agreement, confident that the payment is secure.

- Buyer confirms fulfillment: The buyer confirms that the terms of the agreement have been fulfilled to their satisfaction.

- Funds are released: Finally, the escrow service releases the funds to the seller, completing the transaction.

The Future of Escrow Services in Business Transactions

As businesses and transactions continue to move online, the role of escrow services is set to become even more significant. Escrow services are adapting to these changes by offering digital solutions, such as online escrow platforms, that provide the same level of trust and security as traditional methods. These platforms make the escrow process easier and more accessible for all types of businesses

Escrow services are adapting to these changes by offering digital solutions, such as online escrow platforms, that provide the same level of trust and security as traditional methods. These platforms make the escrow process easier and more accessible for all types of businesses and transactions, irrespective of their scale or complexity.

Escrow services are also innovating to accommodate emerging trends like cryptocurrency transactions. Some services now offer cryptocurrency escrow, holding digital assets securely until transaction conditions are fulfilled. This evolution further underlines the central role of escrow in the future of business transactions.

The Safety Net of Escrow

In any business transaction, the unknown can be intimidating. Escrow services act as a safety net, providing an environment where both parties can feel secure. They assure the buyer that their money will only be transferred once the conditions are met, and they provide the seller with the confidence that the buyer has the necessary funds before they fulfill their part of the deal.

Moreover, escrow services help to prevent fraud by adding an extra layer of verification to transactions. The third-party nature of an escrow service means that the validity of payments can be confirmed, and any potential fraudulent activity can be identified and mitigated.

Making the Right Choice: Selecting an Escrow Service

Choosing the right escrow service is crucial in ensuring a smooth and secure transaction. When selecting an escrow service, consider their reputation, fees, and the level of customer service they provide. It is also important to ensure they have the necessary licenses and follow the regulations applicable in your jurisdiction.

A good escrow service should provide clear communication throughout the process, ensuring all parties understand the terms and conditions of the transaction. They should also have robust security measures in place to protect the funds and personal information of the parties involved.

The Bottom Line: Escrow – The Backbone of Secure Transactions

In conclusion, the role of escrow in business transactions is irreplaceable. It provides a secure and neutral environment that instills confidence in both buyers and sellers. As we move further into the digital age, the importance of escrow services only looks set to increase.

Whether you’re a business owner looking to secure a significant deal, a real estate investor finalizing a property purchase, or an online shopper buying from an overseas vendor, escrow services provide the security and peace of mind you need to navigate the complex world of business transactions.

Escrow services bridge the gap between uncertainty and trust, enabling smoother, safer, and more successful business transactions. Remember, your business transaction is too important to leave to chance. Opt for the assurance that only a trusted escrow service can provide.

Responses